Employer responsibility in unemployment claims: Understanding Chargeback Liability and the Importance of Documentation

Managing unemployment insurance (UI) claims is a key part of controlling long-term unemployment tax rates. A single claim can impact your UI tax rate for up to three years, so it’s important to have a proactive strategy in place. While it may not be realistic to aim for a 0% claim loss rate, employers can greatly reduce their exposure by focusing on proper documentation, timely separations, and clear internal procedures.

This article focuses on how UI claims are evaluated, when an employer may be charged, and what steps you can take to protect your business from unnecessary liability.

Who is Eligible for Unemployment Benefits?

In Texas, most former employees can file for unemployment benefits if they are no longer working. However, not everyone qualifies to receive benefits. According to the Texas Workforce Commission (TWC), the employee must be out of work through no fault of their own to be eligible.

Examples of when a former employee may be eligible:

- They were laid off due to lack of work.

- They were terminated but not for misconduct.

- They quit for a work-related reason such as harassment, unsafe working conditions, or a significant cut in pay or hours.

- They left due to a medically verifiable condition that prevented them from working (though you, as the employer, likely won’t be financially charged in this scenario).

Examples of when a former employee may not be eligible:

- They quit for personal reasons (e.g., going back to school, staying home with a child, moving out of the area).

- They were fired for misconduct, and the employer has documentation proving the misconduct.

Important: If an employee was never capable of performing their job and is terminated for poor performance without documentation of misconduct, the TWC will generally consider that a “bad hire.” In that case, the employee will likely be awarded benefits, and the employer may be financially responsible.

Proving Misconduct: The Employer’s Burden

If you terminate an employee for cause, it’s not enough to say they weren’t performing. To successfully defend a UI claim, the TWC requires that you prove misconduct occurred. This means:

- Documenting all verbal warnings, performance conversations, and formal write-ups.

- Having clear, written policies and expectations in place.

- Demonstrating that the employee knew the rules, was aware that termination was a consequence, and willfully violated them.

The TWC places significant weight on whether the employee was clearly informed that their job was in jeopardy. The final incident must also be specific and recent — vague or cumulative behavior typically won’t qualify unless it’s thoroughly documented and clearly linked to previous warnings.

Without this level of documentation, the claim is likely to be awarded to the former employee, and your business may be financially responsible.

How Employers are Charged

Employers in Texas pay UI taxes on up to $9,000 in wages per employee per year. Your individual tax rate is calculated annually by the TWC and is impacted by your claims history. For every UI claim you lose, the TWC assigns chargebacks to your account — dollar amounts that increase your tax rate over time.

In 2025, tax rates range from 0.25% ($22.50 per employee per year) to 6.25% ($562.50 per employee per year), with the average rate landing at 1.08% ($97.20 per employee per year).

Even one or two successful claims can cause your rate to jump significantly. For example:

- With a 2.0% rate: $9,000 × 2.0% = $180 per employee per year

- With a 3.5% rate: $9,000 × 3.5% = $315 per employee per year

Multiply that across your entire workforce, and the costs add up fast. Employers with clean claims histories can save thousands in taxes each year by keeping their rate low.

Base Period and Chargeback Liability

The base period is the time TWC uses to determine whether an employer will be financially impacted by a UI claim. It includes the first four of the last five completed calendar quarters before the claim was filed.

For example, if a claim is filed in April 2025, the base period would be:

| Base Period Quarter 1 |

Base Period Quarter 2 |

Base Period Quarter 3 |

Base Period Quarter 4 |

Lag Quarter | Quarter in Progress When Claim is Filed |

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

| Included | Included | Included | Included | Not Included | Not Included |

If you hired an employee in March 2025 and terminated them in April 2025, and they immediately filed for unemployment, your company would not be in the base period and would not be charged.

However, if the employee waits to file until later in the year, you may enter the base period and be responsible for a portion of the benefits depending on how long the employee worked and whether there are other employers involved.

Multiple Employers in the Base Period

If more than one employer reported wages for the claimant during the base period, the TWC assigns proportional chargeback liability. That means each employer will be charged in relation to the amount of wages they paid the employee during the base period.

Probationary Periods: Why Early Action Matters

Even though Texas does not legally recognize a probationary period as a factor in denying benefits, it can play a role in minimizing chargeback exposure. Separating clearly unsuitable employees early reduces the chance they will later file a claim in which your company is financially liable.

That said, firing someone during a probationary period does not prevent them from filing a UI claim or being awarded benefits. The only way to reduce financial liability is to ensure:

- The employee’s wages are not included in the base period, or

- The termination was for proven misconduct.

Best Practices to Reduce Risk

While unemployment claims may not be entirely avoidable, there are some things that you, as the employer, can do to reduce your risk, such as:

- Document all performance and conduct concerns, even verbal conversations.

- Issue clear written warnings with expectations and consequences.

- Require written resignation letters from employees who quit.

- Implement a clearly defined onboarding and evaluation period for new hires.

- Train managers to recognize and document patterns of underperformance or policy violations.

- Contact the GBA Human Resources team if you’re unsure whether a separation may lead to a UI claim.

Final Thoughts

Ultimately, success in managing unemployment claims depends on documentation and timely action. Letting a poor-fit employee linger without feedback or documentation can hurt your workplace culture — and your UI tax rate. Early, well-documented intervention gives you the best chance of defending against claims and keeping your tax rates low.

If you have questions or would like help developing stronger documentation or internal procedures, contact our Human Resources team at (210) 775-6082, toll-free at 1-888-757-2104, or **@**********rs.com. We’re here to support you.

Latest News

What is an Employee Benefit Program?

June 4, 2025

An employee benefit program is a comprehensive package of perks and incentives offered by an employer to attract, retain, and support their workforce. These pro...

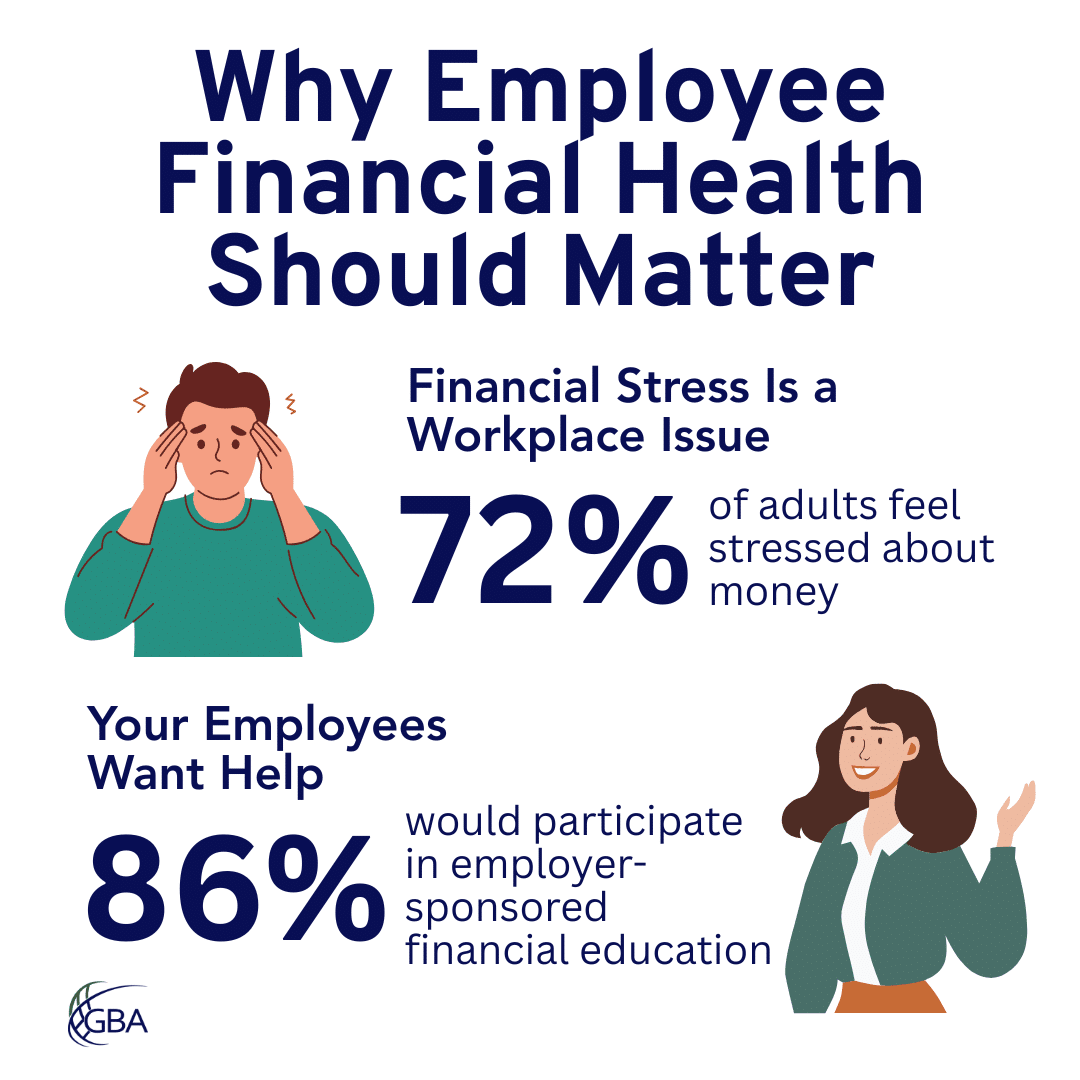

READ MORE...Employee Stress & Financial Health

May 21, 2025

Your employees are stressed, very likely due to concerns about their financial health. According to the 2023 “Stress in America Survey” from the American Ps...

READ MORE...Fiduciary Duties & Employer Risks

May 5, 2025

Offering a variety of employee benefits is a key way to find and retain the best employees. However, this perk is not without its risks and challenges for emplo...

READ MORE...Loading...